Asia Procurement of Medical Items – Where are we now?

2020.9.29

In a previous article, we discussed how COVID-19 has exposed weaknesses in MSF’s procurement system. Specifically, we noted that our reliance on European suppliers undermines the resilience of our supply lines. To rectify this, we need to expand the number and geography of our suppliers. This blog updates our progress finding new suppliers in Asia.

MSF has historically procured a number of generic drugs from India. But there is much more potential in the region. In 2019 we at the Japan Innovation Unit (JIU), together with MSF Logistique, expanded what was then the Japan Procurement Project to become the Asia Procurement Project. That enlarged scope has helped us better understand regional supply and demand, and has meant we can focus more specifically on procuring medical items (i.e. pharmaceutical products and medical devices).

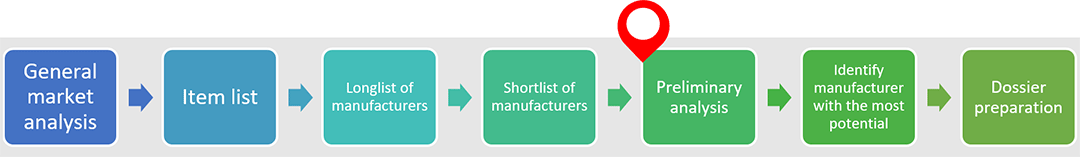

The goal of the current project (figure 1 below) is to validate at least one supplier from the region by mid-2021, and to document and analyze all the lessons learnt in the process so we can verify the feasibility of validating more.

The project also sits within a longer-term vision in which we hope to:

-

1.

Reducing risks of supply interruptions by identifying alternatives for mono-source items

-

2.

Reducing costs by identifying items of lower cost without compromising our quality requirement

-

3.

Reducing delivery time by sending products manufactured in Asia directly to missions

Based on the lessons learnt from the project, appropriate means to scale up will be formulated.

Currently, four countries are within the scope of the project: Malaysia, Thailand, South Korea and China. For each, we are following the workplan given below.

General market analysis

The project began with a general market analysis to understand basic information of each targeted countries, including regulations on medical products, industry development trajectory, the number and type of manufacturers.

Item list

Concurrently, we identified a list of items for which MSF is interested in alternative sources. They include items that regularly experience supply ruptures, and items on which MSF spends the most money (where any savings we might find would have greatest impact). 82 drug items and 16 medical device categories made it onto the list.

Longlist of manufacturers

Beginning with pharmaceutical products, we used the Ministry of Health database of our four target countries to identify over 1,000 manufacturers who can supply the drug items on our item list. As expected, China accounts for the largest number of manufacturers identified (nearly 90%), followed by Korea, Thailand and finally Malaysia.

Shortlist of manufacturers

Out of the longlist of 1,000 manufacturers, we shortlisted those with most potential by checking whether their manufacturing site has been inspected by overseas authorities or international organizations. Although a large majority of manufacturers can only supply one item on our item list, there are several who can supply multiple items. The evaluation process of each manufacturer may be time consuming and even require site inspection. As such, we focused on manufacturers able to supply multiple items as it is more cost-effective to do so. In this way, we have narrowed our list down to about 40 manufacturers.

Preliminary analysis

We are currently in this stage. As such, we are reaching out to our identified manufacturers to obtain some basic information (e.g. registration information, pricing information) for our preliminary analysis.

Next steps

Our immediate target is to identify and prepare a full dossier on at least one manufacturer with great potential. That dossier must then be assessed by International Office (IO), which is responsible for qualifying medical items procured internationally in MSF. While pursuing this objective, we are simultaneously constructing a database of medical items produced in Asia and a contact list of those manufacturing them. This database is itself an invaluable resource that increases MSF’s options when confronted with short-term supply challenges, like those that have occurred during the COVID-19 pandemic.

As our workplan progresses, and as we gain more insights, we shall continue to update you through our blog.

Contact

MSF Japan Innovation Team

MSF Japan Innovation Team is providing innovative ideas of solutions to the MSF activities. If you, either as a company or as a professional, have an idea that would be beneficial to our projects as well as patients, please contact us. Your innovative proposal is always appreciated.

-

E-Mailinnovation@tokyo.msf.org